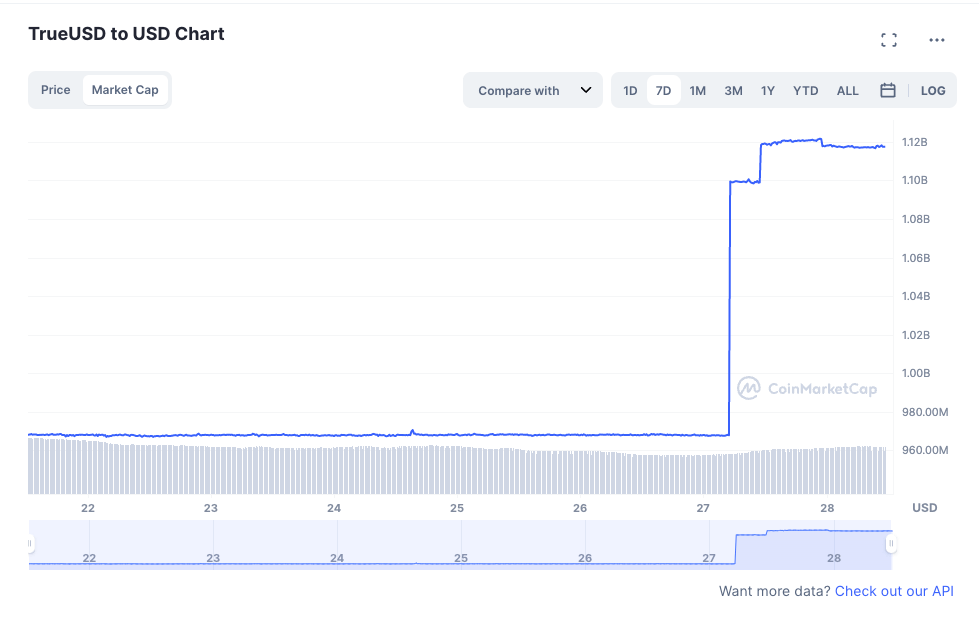

I nai vaiaso talu ai, o le tau o maketi o le True USD (TUSD) ua siʻitia ma ua faʻatulagaina nei, e tusa ai ma le Coin Market Cap, o le stablecoin lona lima tele e ala i mataitusi tetele maketi.

I le 24 itula talu ai, ua si'itia le mataitusi tetele o maketi a le TUSD i luga atu o le 15%, i le taimi nei ua silia ma le $1.1 piliona.

TUSD net outflow grows to meet demand

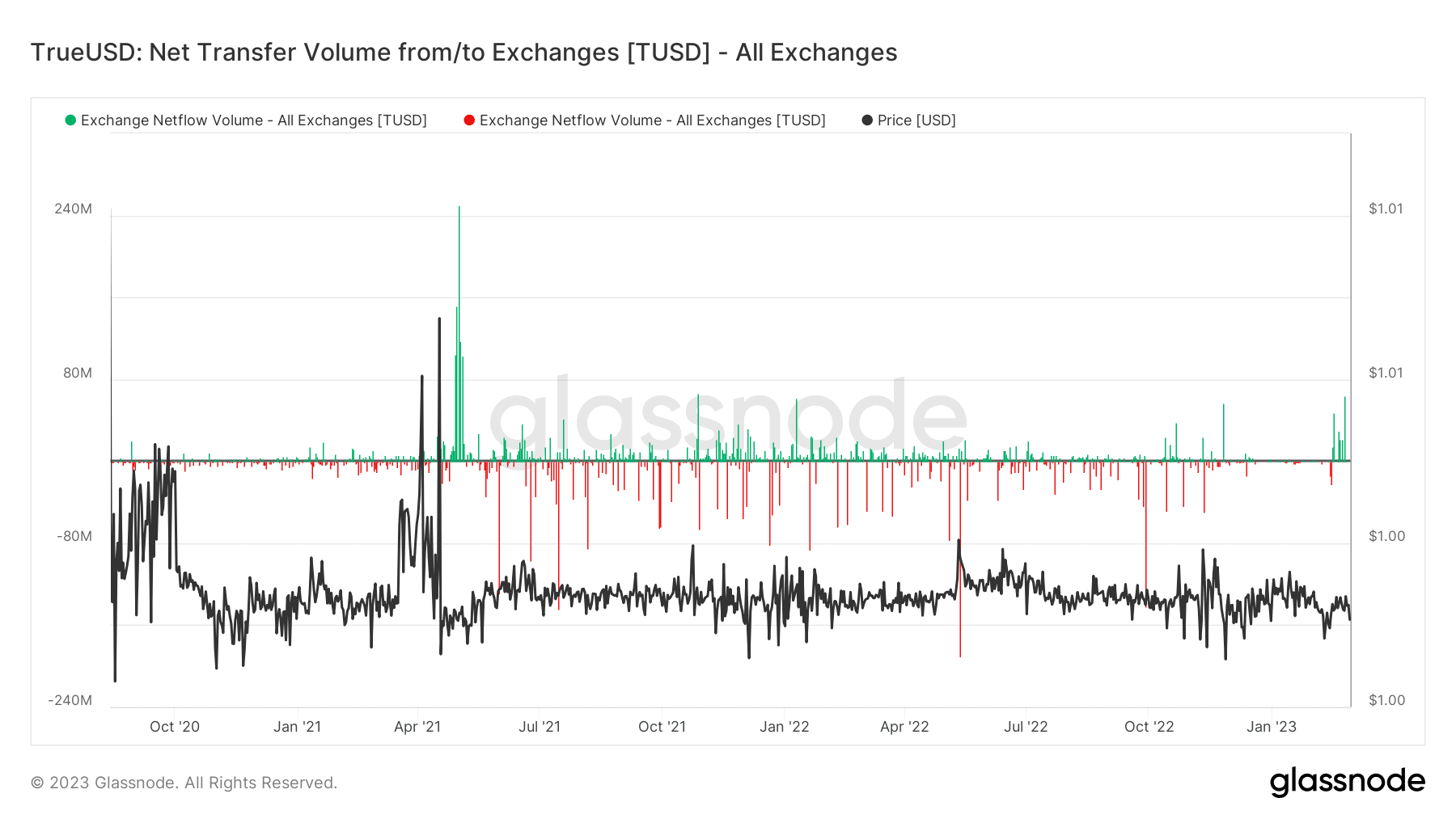

Ole fua ole Netflow a Glassnode ose meafaigaluega aoga mo le suʻesuʻeina o le gaioiga o se cryptocurrency pei ole True USD. Netflow e faasino i le eseesega i le va o le numera o tupe siliva e tafe atu i totonu ma fafo o se fesuiaiga faapitoa poʻo le vaitaele eli. A o'o i luga ole 0 le tau ole Netflow, e ta'u mai ai ua tele atu tupe ua tafe atu i totonu ole vaitu'i fa'atau/liina nai lo le tafe mai.

I le faʻaaogaina o lenei fuataga, ua matauina e Glassnode o le True USD's activity level ua faʻateleina talu ai nei. E mafai ona iloa lea i le pa'u tele o vaega o gaoioiga i luga o le siata a'o le'i o'o ia Fepuari, sosoo ai ma se pikiina iloga i lena masina.

Additionally, the Netflow graph has shown a significant positive increase, which has not been seen since October 2021. As of the time of writing, the Netflow for True USD has surpassed 478,000 TUSD.

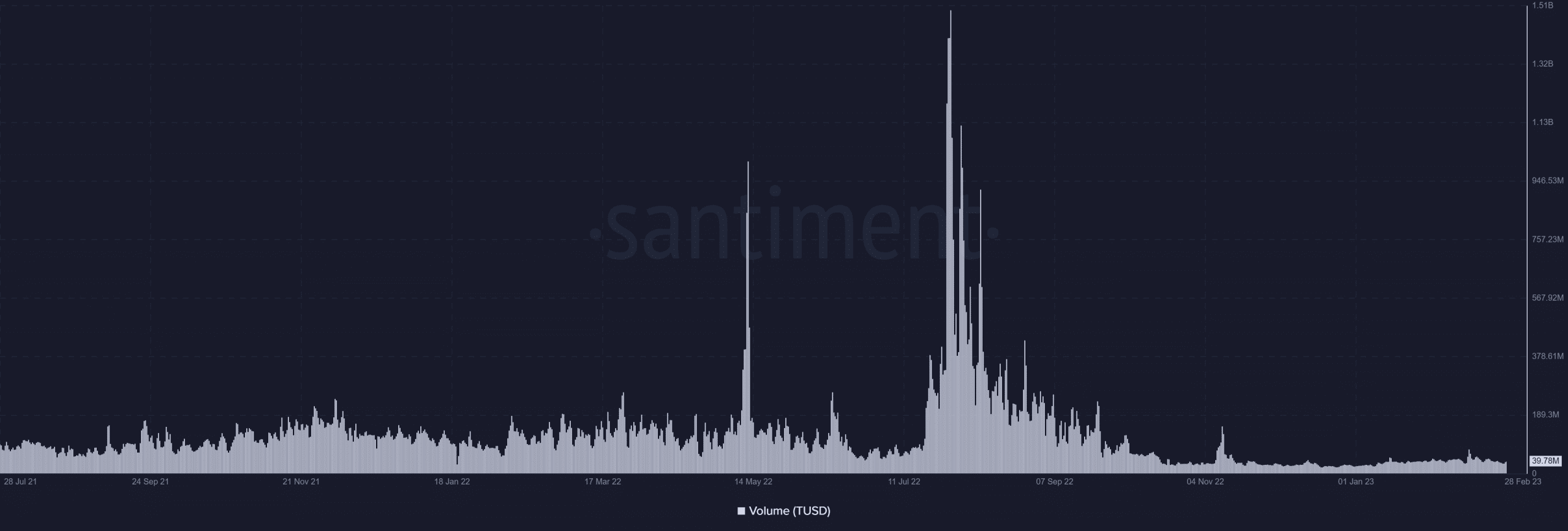

Santiment shows bullish behaviour on TUSD volume YTD

Examining Santiment’s volume metric reveals that TUSD had displayed a rather unimpressive level of activity. However, there are indications of a slight increase in engagement.

Market for stablecoins heating up

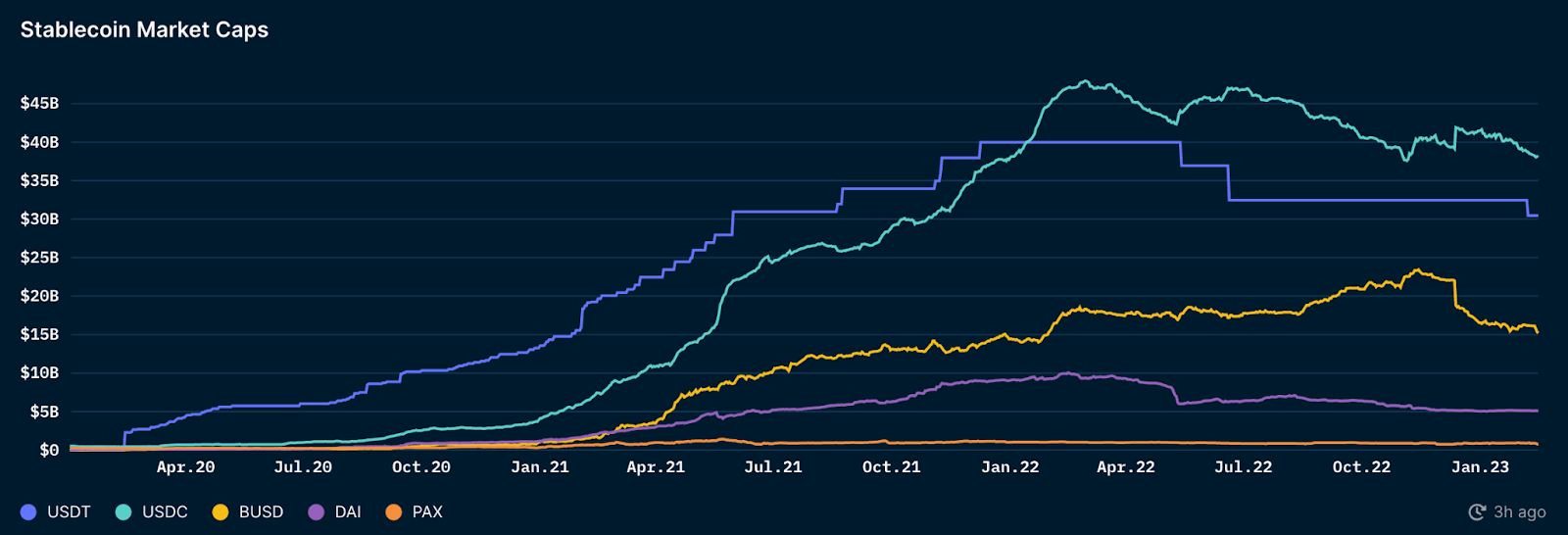

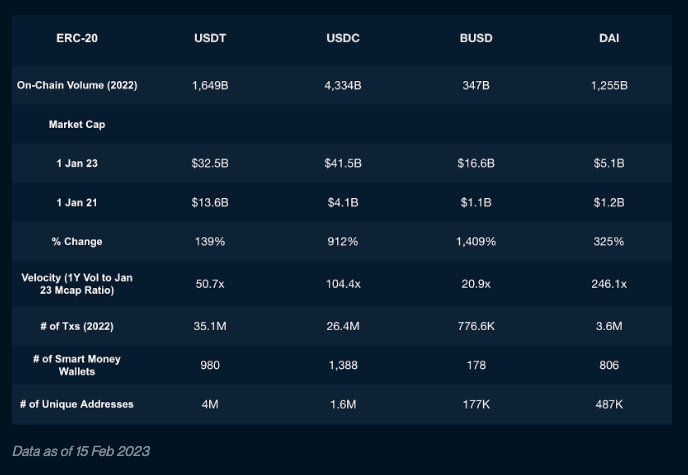

There are several popular types of stablecoins in the market, including decentralized under-collateralized algorithmic (UST), decentralized over-collateralized asset-backed (DAI), and centralized 1:1 backed versions such as USDC, USDT, and BUSD.

During the previous 24 months, BUSD and USDC have experienced remarkable growth, expanding by roughly 1409% and 912%, respectively. Stablecoins are most often available via centralized exchanges (CEXes) and bridges. An overview of the big four:

BUSD flight likely fuelling growth of other stablecoins

Recent blockchain research by Nansen reveals that Binance USD (BUSD) has been facing a decline in demand, while TUSD has been gaining popularity in the market. This shift in demand could be due to the recent news that Coinbase intends to delist BUSD because of regulatory issues.

As per the same Nansen report, Binance appears to be attempting to recover its position by minting around $130 million worth of TUSD in the past week, suggesting a growing reliance on TUSD by the exchange. This move could further contribute to the increase in TUSD’s market cap, as investors doubt the sustainability of BUSD in the market.

However, despite TUSD’s recent uptick, its market valuation is still considerably smaller than that of Dai (DAI), which is currently the fourth largest stablecoin in terms of market capitalization, worth more than $5 billion. This suggests that while TUSD may be gaining ground, it still faces stiff competition from the top players in the stablecoin market.

Source: https://cryptoslate.com/true-usd-becomes-5th-largest-stablecoin-after-market-cap-surges-15/