- MakerDAO’s total revenue declined over the past month.

- However, MakerDAO’s TVL continued to grow amidst its partnership with GnosisDAO.

E tusa ai ma faʻamatalaga fou na tuʻuina mai e Mesari, MakerDAO’s revenue declined significantly over the last 30 days, despite showing growth in other areas.

faitau Va'aiga Tau a le MakerDAO [MKR]. 2023-2024

The total revenue generated by MakerDAO decreased by 19.62% over the past month. Even though the decline in revenue could indicate troubling times for MakerDAO, the blockchain continued to make new collaborations.

Fou faiga paaga

I se talu ai nei tweet, it was revealed that MakerDAO and GnosisDAO took part in a strategic alliance. Thus, MakerDAO could use GnosisDAO’s token, GNO, as collateral. Along with that, GnosisDAO could use DAI as the prominent stablecoin in its ecosystem.

Two powerful DAOs, one powerful purpose.@MakerDAO ma @GnosisDAO join forces to launch the DAO-to-DAO strategic alliance. pic.twitter.com/yTHEdtcUN9

- Tagata fai (@MakerDAO) Tesema 14, 2022

Well, this can certainly give way to positive developments for MakerDAO and might help the blockchain see growth in terms of revenue.

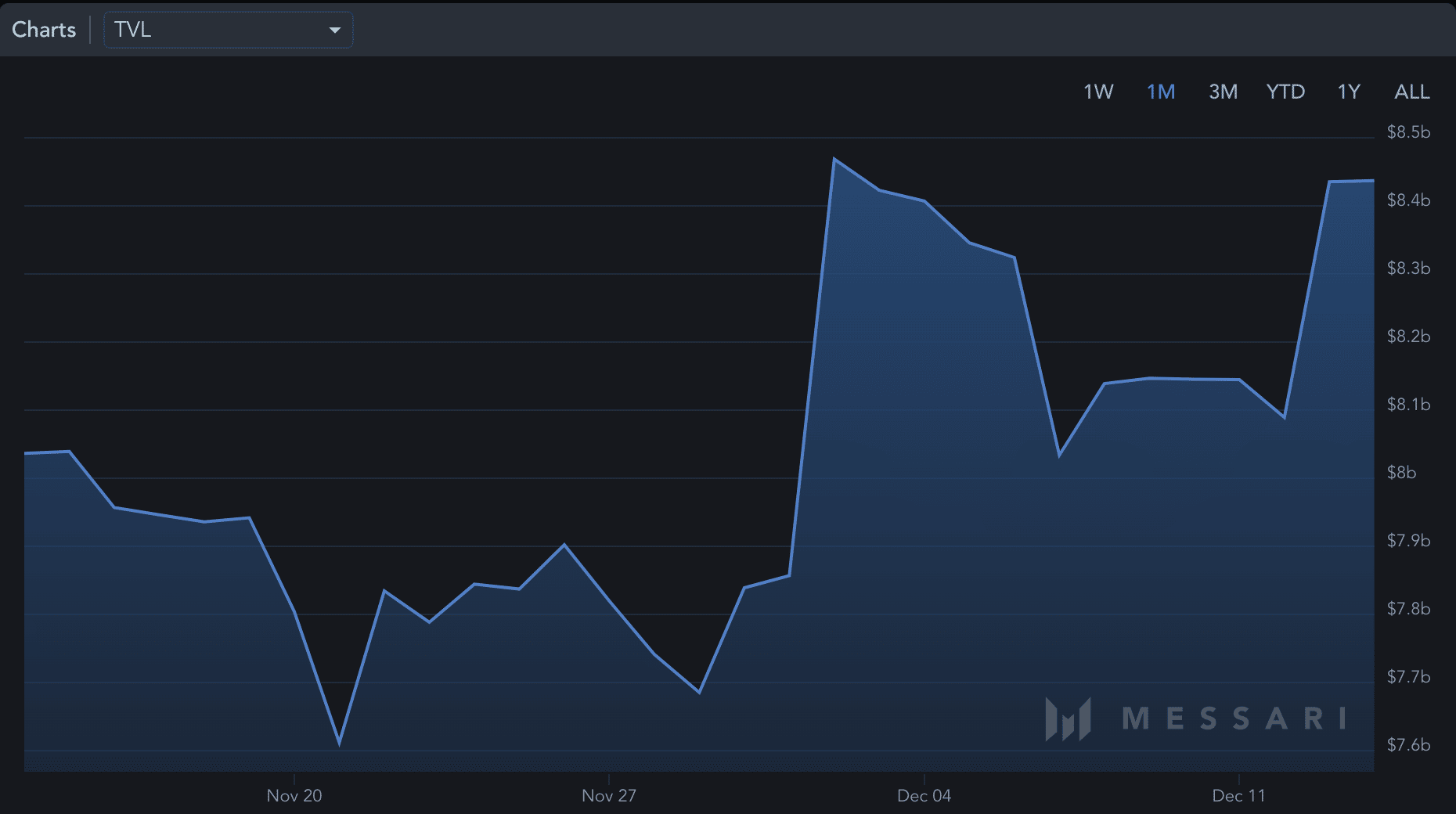

Despite the declining revenue, MakerDAO’s TVL, which was at 7.6 billion on 20 November, grew to 8.4 billion, at the time of writing.

Although MKR’s TVL continued to grow, its volume decreased.

Multiple factors at play for MakerDAO

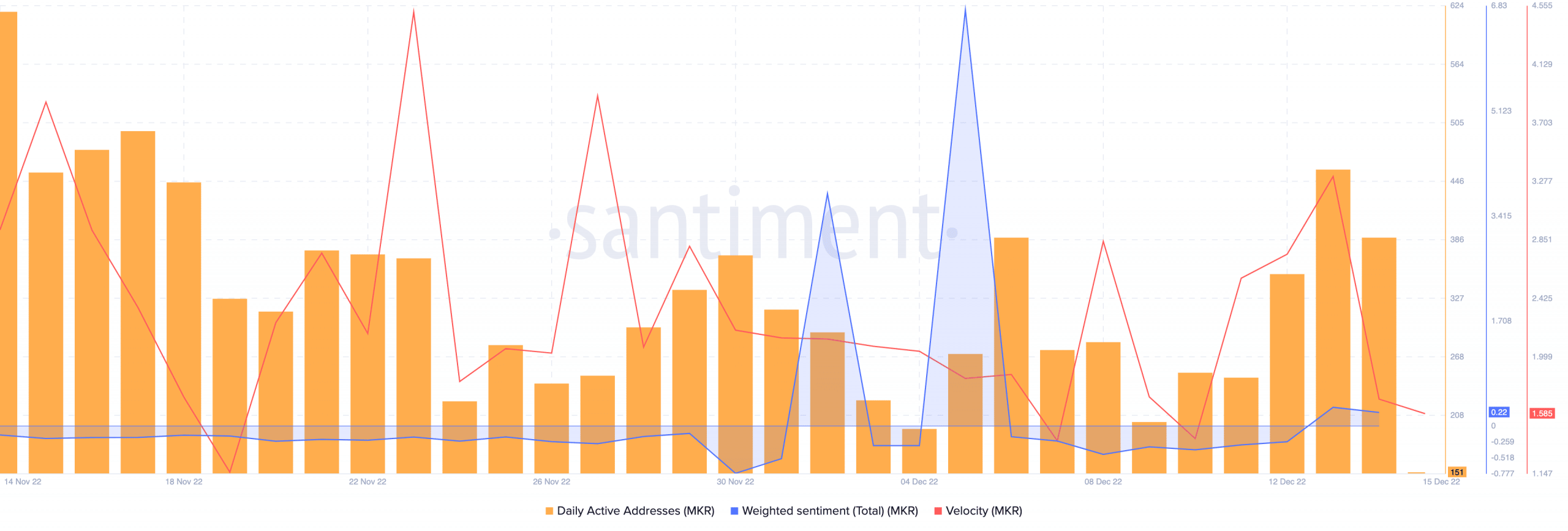

Data from Santiment noted that the MKR’s volume declined materially over the past month, from 31 million to 20.66 million. This decline in volume was accompanied by the declining price of MKR.

However, despite this, whales remained interested in MakerDAO. There was a massive spike in whale interest, especially after 16 November, as the percentage of MKR held by top addresses increased. The interest remained relatively the same throughout the last month.

Although the whales had been showing interest in MakerDAO, retail investors weren’t so kind.

The number of daily active addresses dropped, along with velocity, which implied that the number of times MKR was transferred amongst addresses had decreased.

Another indicator of a reduction in interest from retail investors would be MakerDAO’s declining weighted sentiment. The sentiment reached massive highs on 5 December, after which the metric went on a decline. A declining weighted sentiment indicated that the crypto community had a negative outlook toward MakerDAO.

Layoffs instead of payoffs

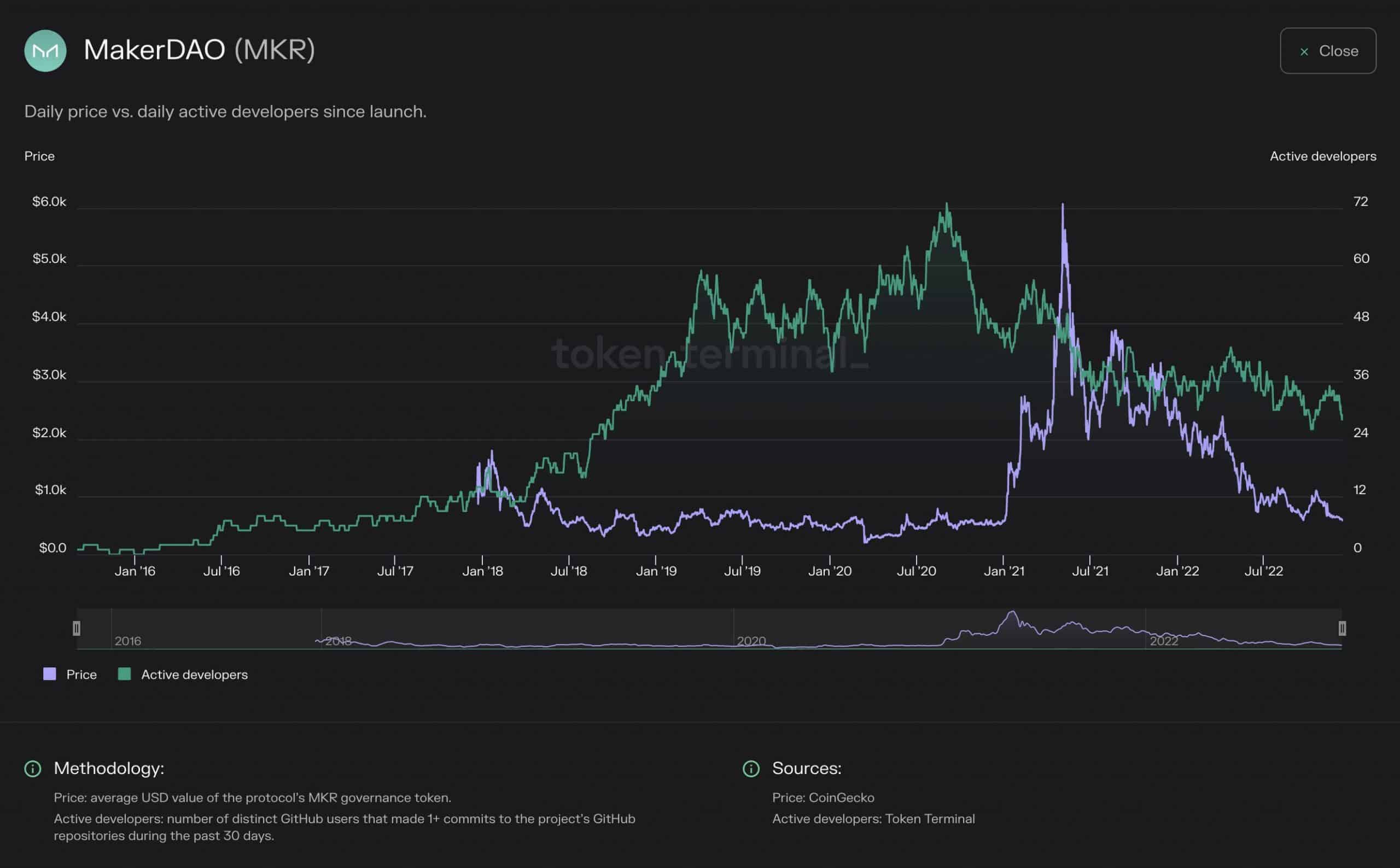

That being said, another alarming factor to consider while looking at MakerDAO would be the declining daily active developers. Data from Token Terminal reported that the number of daily active developers had declined. This was indicative of the fact that there were layoffs at MakerDAO.

Well, the news of layoffs was confirmed via a tweet by Doo Wan Nam, a delegate at MakerDAO.

At the time of writing, MKR was trading at $601.32. Its price declined by 0.38% in the last 24 hours, according to CoinMarketCap.

Source: https://ambcrypto.com/should-makerdao-declining-revenue-be-a-cause-of-concern-for-mkr-holders/